Goldman Sachs forecasts indicate a mere 3% annual return for the S&P 500 over the next decade, a stark contrast to the 13.3% annual returns of the past 10 years. Understand the reasons behind this prediction and how to prepare for this scenario.

###The Phenomenon of the Last 10 Years:

The S&P 500 has shown impressive growth over the past decade, with a total return of 198%, equivalent to an annualized average of 13.3%. Several factors contributed to this exceptional performance:

- Technology Sector Dominance: Tech giants like Apple, Amazon, Google, Facebook, Microsoft, Nvidia, and Tesla propelled the index with their explosive growth.

- Expansionary Monetary Policy: Years of low interest rates from the Federal Reserve (FED) made borrowing cheaper, encouraging corporate investment and consumption, and making stocks more attractive than fixed-income securities.

- Strong Earnings Growth: Many S&P 500 companies experienced substantial earnings growth, supporting stock prices.

- Global Economic Expansion: Worldwide economic growth, even with periods of slowdown, benefited companies with international exposure.

- Post-Pandemic Recovery: Government stimulus and liquidity injections by the FED fueled the market recovery after the initial shock of the pandemic.

The Pessimistic Forecast and its Rationale:

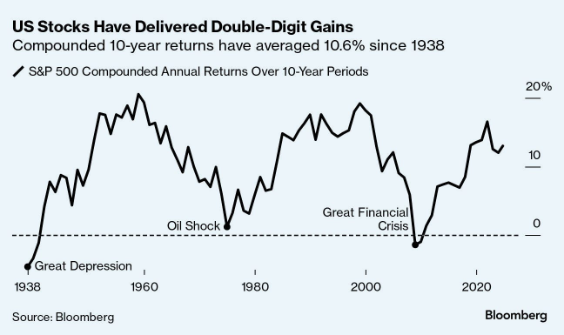

Goldman Sachs projects an annualized return of only 3% for the S&P 500 over the next 10 years. This projection, significantly below the historical average of 11%, is based on some worrying factors:

- High Concentration in a Few Stocks: The index's dependence on the performance of a small group of companies, mainly in the technology sector, represents a considerable risk. History shows it's difficult for any company to maintain high levels of sales growth and profit margins for extended periods.

- High Valuations: Stocks are expensive. Investor optimism and low interest rates have led to price-to-earnings multiples above the historical average, indicating a possible market overheating. Persistent inflation could further pressure these multiples.

- Probability of Stocks Trailing Bonds: Goldman Sachs estimates a 72% probability that stocks will underperform bonds over the next decade.

###Alternatives and Strategies:

Given this scenario, diversifying your investments is crucial. Some alternatives to the S&P 500 include:

- Equal Weight ETFs: Distribute investment equally among all stocks in the index, reducing risk concentration.

- Global Funds: Broaden the investment horizon beyond the US market.

- Value Stocks: Solid companies with a history of consistent profits, trading at prices below their intrinsic value. They typically offer higher dividends but with lower explosive growth potential. Examples: AT&T, Home Depot, Procter & Gamble.

- Small Caps: Companies with smaller market capitalization, which may offer higher growth potential but also higher volatility.

In addition to diversification, it's essential to:

- Create an investment plan and stick to it.

- Invest consistently over time.

- Focus on investments you understand.

- Risk only what you can afford to lose.

- Reinvest dividends received.

- Avoid making decisions based on panic or emotion.

If you are approaching retirement, preparing for a scenario of more modest returns in the stock market is even more critical. Consult a professional to adjust your investment strategy to your specific situation. Articles like Planning a Comfortable Retirement: 3 Crucial Steps and Financial Freedom: The Importance of Retiring Early and Continuing to Work on Yourself can help you in this process.

###Conclusion: The Goldman Sachs forecasts for the S&P 500 serve as a wake-up call for investors. The era of exceptional returns may be ending, and it's crucial to prepare for a scenario of more moderate growth. Diversification, planning, and discipline are key to navigating this new context successfully. The pursuit of knowledge and solid financial education, as discussed in The Crucial Difference Between Financial Entertainment and Financial Education, becomes even more important to ensure a prosperous financial future.